How overdraft fees are changing in 2025

In 2025, overdraft fees are changing due to new regulations that prioritize consumer protections, increase transparency, and provide more options for avoiding fees, with a focus on digital banking and personalized services.

How overdraft fees are changing in 2025 is a topic that affects millions of bank customers. As new regulations roll out, you might wonder how these changes will alter your banking experience. Let’s dive into what’s ahead!

Understanding overdraft fees and their implications

Understanding overdraft fees is crucial for anyone who uses a bank account. These fees occur when you spend more money than you have in your account, leading to charges from your bank. In this section, we’ll explore what these fees are and how they can affect your financial health.

What are overdraft fees?

Overdraft fees are penalties charged by banks when you withdraw more funds than are available in your checking account. These fees can vary but are typically around $30 to $40 per transaction. It’s essential to understand these charges to avoid them.

How overdraft fees work

When you attempt to make a purchase that exceeds your account balance, the bank may allow the transaction, resulting in an overdraft. This service may be helpful for essential payments, but it can lead to hefty fees. Here are some important aspects to consider:

- If you opt into overdraft protection, you may also face fees for this service.

- Continually overdrafting your account can lead to a series of fees, spiraling your financial status further.

- Some banks may limit the number of overdraft fees incurred within a certain period.

It’s crucial to monitor your bank account regularly to understand your spending habits. By keeping a close eye on your balance, you can prevent triggering these fees altogether. For those who encounter cash flow issues, overdraft fees can compound quickly, leading to significant financial strain.

Additionally, some consumers might be unaware of their bank’s specific policies regarding overdrafts. Not all banks treat overdrafts the same way. Each institution may have different rules, which can affect how fees accumulate. Therefore, it’s essential to read the fine print on your banking terms to understand how overdraft fees will impact your finances.

By becoming more informed about your accounts, you can minimize the risk of overdraft fees and manage your money more effectively. This knowledge empowers you to make better financial decisions and avoid unnecessary costs.

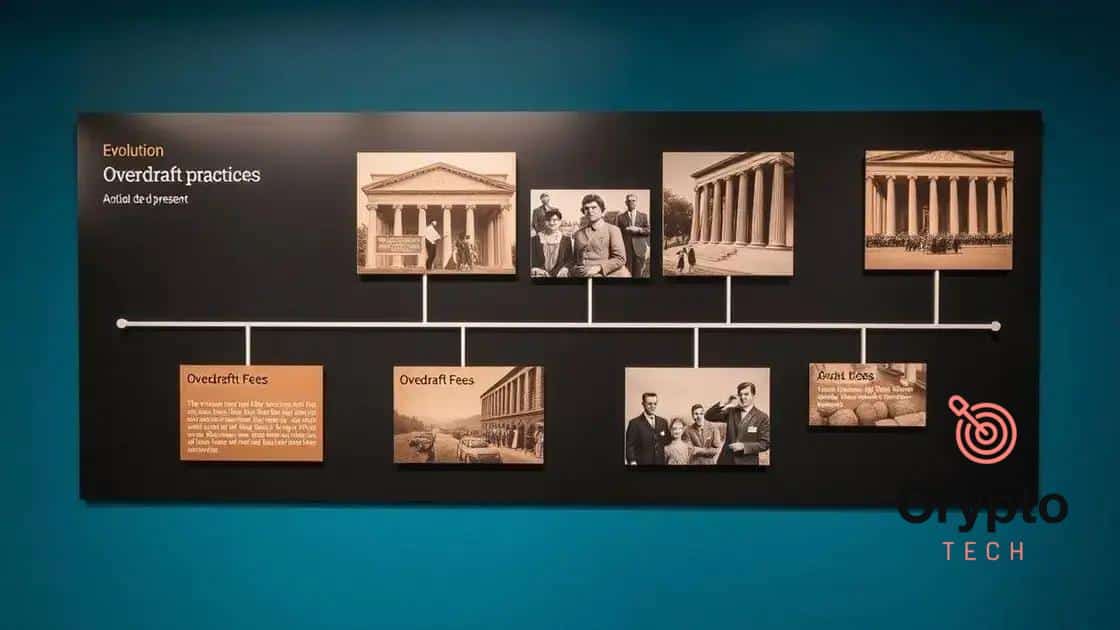

The history of overdraft fees in banking

The history of overdraft fees in banking dates back several decades. Banks have used these fees as a way to manage risk and ensure that they can cover overextended accounts. Understanding this history is vital in grasping how these fees evolved.

Early development of overdraft fees

Overdrafts were less common in the early days of banking. Most people used cash for transactions, which limited the risk of overspending. However, as banking systems modernized and checks became popular, banks started facing issues with customers exceeding their account balances.

Regulatory changes

During the late 20th century, federal regulations began to shape how banks could charge overdraft fees. These changes aimed to provide more transparency and protect consumers from exorbitant fees. The way banks communicated their policies to consumers has also transformed over the years.

The early 2000s saw a significant rise in the use of debit cards, which made it easier for people to overdraw their accounts. Banks recognized this trend and adjusted their overdraft policies accordingly. The fees became a standard part of banking, leading to greater scrutiny from regulators and advocacy groups.

- In 2010, the Federal Reserve introduced regulations requiring banks to obtain consumer consent for overdraft services.

- This led to a decline in the number of overdraft transactions, as many customers opted out of the service.

- The public outcry over high fees has prompted some banks to lower or eliminate these charges.

As of today, overdraft fees continue to be a contentious topic. While many banks still impose these charges, the landscape is evolving. New financial technologies are also emerging, providing consumers with alternatives to traditional banks.

New regulations affecting overdraft practices

New regulations affecting overdraft practices have been introduced to protect consumers and provide more clarity in banking transactions. These changes aim to ensure that banks are more transparent about their fees and offer better choices for consumers.

Key changes in legislation

Over recent years, lawmakers have scrutinized how banks manage overdraft fees. One significant change is the requirement for banks to obtain explicit consent from customers before enrolling them in overdraft protection plans. This move empowers consumers to make informed decisions about their accounts.

Impact on consumers

This regulatory shift means that consumers now have greater control over potential overdraft charges. Many consumers are now more aware of their rights and how they can avoid unnecessary fees. As a result, customers may opt out of overdraft programs if they feel it is advantageous for their financial well-being.

- Banks are now required to provide clearer disclosures regarding overdraft fees.

- Customers can choose to decline overdraft protection, preventing future fees.

- Some banks have introduced lower fees or alternatives to provide more consumer-friendly options.

These changes have created a more equitable banking environment, where consumers can navigate their finances without fear of surprise charges. With increased transparency, customers can better understand how their transactions affect their account balances and fees.

As this trend continues, more institutions may adapt their overdraft policies, further impacting how fees are managed. Keeping up with these changes will be essential for consumers looking to manage their finances effectively.

How consumers can avoid overdraft fees

Understanding how consumers can avoid overdraft fees is essential for effective financial management. By adopting specific habits and strategies, individuals can protect themselves from unnecessary charges.

Track your spending

One of the best ways to avoid overdraft fees is to closely monitor your account balance. Regularly checking your spending can help you know how much money you have available. Consider using mobile banking apps that provide real-time updates on your account balances.

Set up low balance alerts

Many banks offer the option to set up alerts for low balances. By doing this, you will receive notifications when your account drops below a certain amount. Here are some tips:

- Choose a threshold amount that makes sense for your spending habits.

- Activate notifications through text messages or email.

- Regularly update your alert preferences based on your financial situation.

This proactive approach can prevent you from accidentally overdrawing your account. When notified, you can adjust your spending or transfer funds as necessary.

Another effective method is to maintain a buffer in your checking account. By keeping a small cushion, ideally enough to cover any sudden expenses or overspending, you can reduce the risk of overdrafts. Additionally, customers should know their bank’s policies regarding overdrafts.

Understanding rules about overdraft protection and associated fees can empower you to make choices that minimize the risk of charges. Many institutions now offer overdraft protection plans, often with lower fees than standard overdrafts.

Using a combination of these strategies, consumers can significantly reduce their chances of incurring overdraft fees. Awareness and proactive management are vital to maintaining healthy finances.

The future of banking: trends to watch

The future of banking is evolving rapidly, with trends that will significantly impact how consumers manage their finances. Understanding these changes is crucial for adapting to the new banking environment.

Digital banking growth

The shift to digital banking continues to accelerate. More people are using online and mobile banking services instead of traditional bank branches. This trend offers convenience and 24/7 access to banking services. People can easily check their accounts, pay bills, and transfer money at any time.

Fintech innovations

Financial technology (fintech) companies are driving innovation in banking. These companies offer unique solutions that challenge traditional banking norms. Examples include peer-to-peer lending platforms, digital wallets, and robo-advisors. Many consumers are turning to these options for lower fees and faster service.

- Mobile payment apps enable quick and easy transactions.

- Cryptocurrency platforms provide alternative investment opportunities.

- Budgeting and savings apps help consumers manage their finances effectively.

As fintech grows, it’s likely that traditional banks will need to adapt by incorporating similar technologies to stay competitive. Consumers will benefit from improved services and lower costs as banks evolve.

Another trend to watch is the increased focus on personalized services. Banks are beginning to use data analytics to understand customer preferences better. By analyzing spending habits, banks can offer tailored financial products and advice that meet individual needs.

Regulatory changes will also shape the future of banking. As governments respond to new technologies and consumer concerns, they may introduce rules that protect customers and ensure fair practices. These regulations can influence how banks operate and how they charge fees.

Keeping an eye on these trends will help consumers make informed decisions about their banking options. The future of banking promises convenience, innovation, and increased access to financial services for everyone.

FAQ – Frequently Asked Questions about Overdraft Fees and Banking Trends

What are overdraft fees?

Overdraft fees are charges that banks impose when you spend more money than you have in your account, allowing transactions to go through but at a cost.

How can I avoid overdraft fees?

You can avoid overdraft fees by tracking your spending, setting up low balance alerts, and maintaining a buffer in your checking account.

What are the latest trends in banking?

The latest trends include digital banking growth, fintech innovations, personalized services, and increased regulatory focus on consumer protection.

How do new regulations affect banking?

New regulations aim to provide transparency in banking practices, protect consumers from high fees, and enhance overall access to financial services.